Pricing starts at £19 a month for sole traders and £29 a month for limited companies, with 50 per cent off for the first six months.įreeAgent says its users can comply with Making Tax Digital, and has been submitting digital VAT returns to HMRC for customers since 2010. You can set invoice reminders and upload pictures of your receipts.

#Gnucash online manual software

It’s a cloud accounting software package. Some of the benefits of using cloud accounting software include:Ībility to connect to other third-party accounting apps for invoicing and cash flowįreeAgent is targeted at freelancers and small businesses, so it focuses on daily admin tasks like invoicing, time tracking, and expense management.

You just need an internet connection and you’ll be able to sign into a secure system using your web browser or an app. What is cloud accounting software?Ĭloud accounting software is accounting software that’s available online (rather than stored locally on your desktop). However, if you decide to buy, bear in mind that the prices shown usually don’t include VAT.

#Gnucash online manual trial

Many of the paid subscription services mentioned below offer a free trial (usually one month) when you first sign up so you can try it out to see if it suits your needs. Most of these programs are mobile-friendly too.

#Gnucash online manual mac

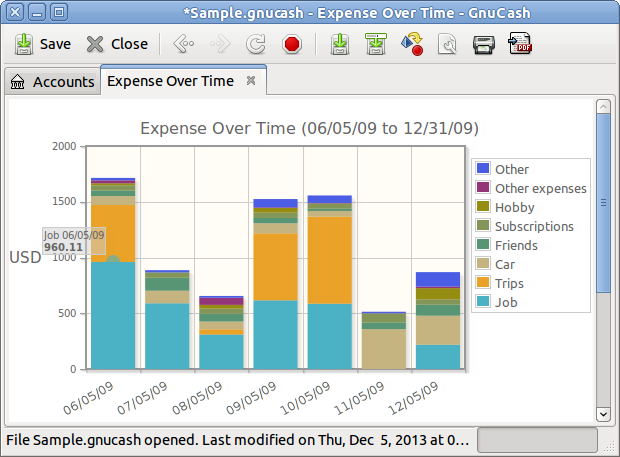

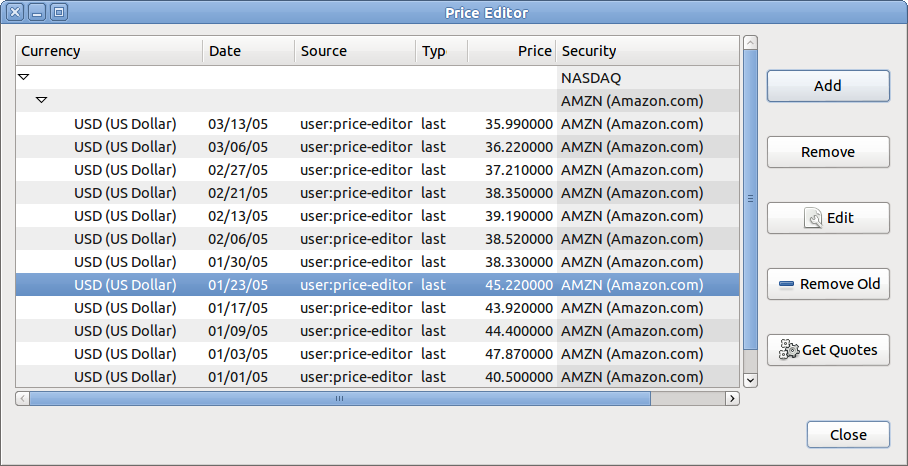

Modern accountancy packages tend to be cloud accounting software, so they should work fine whether you use a Mac or PC. But we’ve taken a look at some of the best-known options for your business. The sheer number of programs and providers available can make it hard to compare accounting software, let alone choose a package to suit your needs. Accounting software comparison for small businesses The product you pick will usually include reporting tools as well, so you can track your cash flow and monitor your profit and loss, for example.Īnd with Making Tax Digital now in force, businesses need to make an informed choice about the accounting software they use to keep digital records and send tax returns. This type of software is designed to make it easy for you to manage your business finances, helping you with things like bookkeeping, invoicing, purchase orders, statements of account, inventory, and payroll. Many of the products are inexpensive (or even completely free). Now, there’s a huge range of accounting software that’s been designed especially for small businesses and the self-employed.

It was generally more suitable for large enterprises than small businesses. In the past, accounting software was complex and cumbersome. Accounting and bookkeeping software for business Use this as a guide – before choosing a package, make sure you’ve researched and worked out whether it meets all your business’s needs. With lots of self-employed accounting software options out there, this guide aims to help you pick one that works for your business. Making Tax Digital means all VAT-registered businesses (regardless of their turnover) need to use compatible software to submit their VAT returns. And after HMRC introduced Making Tax Digital in April 2019, it’s more important than ever for businesses to consider accounting software.

0 kommentar(er)

0 kommentar(er)